The SEC and Social Media: What NOT to Do + Compliance Tips

Social media is kind of magical, right? With just a few taps on the keyboard, you can share any message you want with the whole wide world.

But with great power… comes great potential to get yourself in trouble with the SEC. Gulp.

Even if you don’t take your social media content too seriously, the U.S. Securities and Exchange Commission (SEC) does. The SEC can — and will! — hold businesses accountable for the things they say on social media platforms.

So before you post that hilarious meme about investing in crypto or share an impromptu TikTok vid about splitting your stock, take a beat to make sure you really understand how to comply with SEC regulations on social media.

After all, you’re using social media to build your brand, not commit fraud. (Right?) So read on for everything you need to know to stay in the SEC’s good books. Grow your client base with the tool that makes it easy to sell, engage, measure, and win — all while staying compliant.

What is the SEC?

The U.S. Securities and Exchange Commission (SEC) is an independent agency of the federal government responsible for enforcing federal securities laws and regulating the securities industry.

Its three-pronged mission is to protect investors, facilitate capital formation, and maintain fair and efficient markets. In other words: the SEC is trying its very best to make the American economy an even playing field.

Here are the principles the SEC is working to uphold, according to SEC.gov:

- “Companies offering securities for sale to the public must tell the truth about their business, the securities they are selling, and the investment risks.”

- “Those who sell and trade securities and offer advice to investors — including, for example, brokers, dealers, investment advisers, and exchanges — must treat investors fairly and honestly.”

There are many different ways the SEC regulates and enforces their mission.

One key activity, of course, is monitoring social media platforms for potential fraud.

What is the role of the SEC on social media?

With the rise of social media’s influence on investment decisions (we see you, #cryptotok), the SEC has had to adapt its regulatory oversight to include social platforms.

In other words: the SEC may very well be watching your Instagram Reels.

The SEC is on the lookout on every social platform to identify potential violations, monitor fraudulent activities, and ensure the fair disclosure of information.

It’s a proactive approach that aims to protect investors from misinformation and market manipulation. (But, hopefully, they don’t forget to like and subscribe while they’re there.)

The SEC also has a few social accounts of its own, in case you were wondering: Twitter, Facebook, Youtube, and LinkedIn.

Who should care about the SEC and social media?

While the SEC’s regulations on social media affect a wide range of people and organizations, those involved in the financial services industry should pay particularly close attention.

Social media managers, financial advisors promoting their businesses, wealth management advisors, and public companies sharing investment and financial information should be hyper-aware of SEC rules to avoid potential infractions.

But even an enthusiastic Lindsay Lohan can get into trouble for promoting stocks without disclosing that she received compensation to do so. No one is safe.

SEC rules for social media

To make sure everyone is communicating about investments with fairness and transparency, the SEC has established marketing rules regarding what you can and cannot do on social media platforms.

What you CAN’T do

Make misleading statements: It is prohibited to make false or misleading statements about a company’s financial condition, performance, or future prospects.

For instance, tweeting a lie that your car-manufacturing company is about to put out a flying car would be a real no-no.

Share insider information: Sharing non-public, material information that could influence investment decisions is strictly prohibited.

For instance, if you know you’re about to fire your whole executive team, don’t announce it on LinkedIn first. That’s information that could give your followers an unfair heads-up that they should dump their stock.

Engage in manipulative practices: Engaging in manipulative practices to artificially inflate or deflate securities prices is illegal.

For instance, practicing what’s called a “pump and dump” scheme: colluding with your friends to really hype up an “amazing” new cryptocurrency called “Barbiecoin” so that everybody else buys it too, and you can then sell it for more than its actual worth.

What you CAN do

Make disclaimers: Including appropriate disclaimers when sharing investment advice or opinions on social media can help clarify that the information is not intended as financial advice.

For example, before you share your excitement about a new stock you’ve just purchased, remind your followers that this is just your opinion and not guaranteed financial advice.

Offer clear and balanced information: Ensure that all material information shared on social media platforms is accurate and balanced and does not omit important facts that may impact investment decisions.

In other words: do your homework before you start talking about a new mutual fund on your Instagram Stories and make sure you talk about it objectively, including both pros and cons.

Provide timely disclosures: Public companies must adhere to the same rules regarding the timely disclosure of material information on social media platforms as they would with traditional communication channels.

When a piece of information is considered “material,” it means that it has the potential to influence an investor’s decision-making process or the market value of a security. This includes information about financial results, mergers and acquisitions, significant contracts, regulatory developments, or any other data that could impact investors’ perception of the company’s prospects.

How does the SEC affect influencers?

Influencers have become a particularly powerful force on social media platforms when it comes to financial information. Content creators have the ability to shape public opinion and influence consumer behavior — for better or for worse.

It’s important to know that the SEC’s regulations apply to influencers as well, particularly when an influencer endorses or approves investment opportunities or provides financial advice.

In December 2022, the SEC charged eight social media influencers for their participation in a $100 million securities fraud scheme. These individuals have been accused of sharing misinformation with followers on Twitter and Discord in order to boost the price of stock they planned to dump. (Hey, Adam McKay: is this the perfect plot for The Big Short 2?)

If these charges are true, this seems like this case involves some pretty intentional fraud behavior, but even well-intentioned influencers can get into trouble if they aren’t crystal clear about conflicts and objectivity.

TLDR: Always be transparent! Influencers must disclose any potential conflicts of interest and make it clear when their statements are opinions rather than objective financial advice.

Tips for preventing SEC infractions

We all want to play by the rules, right? We want to stay out of trouble and ensure beyond a shadow of a doubt that we’re not negatively impacting anyone else’s financial well-being. To stay compliant with SEC regulations and reduce the risk of infractions, consider the following strategies:

Educate your team

Ensure that all employees who manage social media accounts or engage in any communication related to investments or financials are well-informed about SEC regulations.

That could mean sharing this blog post (bless you) or a more formal info sesh.

Training sessions and guidelines can help everybody get familiar with the do’s and don’ts of social media compliance.

It’s really the first step in cultivating a company culture that prioritizes compliance and ethical practices on social media. Encourage open communication, reporting of potential violations, and ongoing education to ensure everyone understands their responsibilities.

Create a clear social media policy for employees

Even if you’ve had a million training sessions with your team, it doesn’t hurt to add SEC regulations to your company’s social media policy.

And if you don’t have a social media policy yet, there’s no time like the present. There’s really no better way to ensure consistent and compliant messaging across social media platforms. Check out our social media policy template here.

Bonus: Get a free, customizable social media policy template designed specifically for banks to quickly and easily create guidelines for your financial institution.

Consult a compliance officer

Who better to ask for support than an expert?

It’s well worth the investment to engage a compliance officer or legal counsel with expertise in securities laws to review social media activities and provide guidance on compliance best practices. Then you’ll never have any lingering doubts about whether or not you actually understand what “material information” is. Take this free 45-minute course and become a social media expert. Learn how to drive leads, protect your brand, prove your impact, and more.![]()

Set up a social listening program

A great social listening tool will help you monitor and detect any transmission of insider information from employees, influencers, or others associated with your organization.

May we humbly recommend Hootsuite’s advanced social listening features? See what people are saying about your brand, industry, and competitors with the most powerful social listening tool around, and catch potential violations before they go public.

Keep messaging on brand with an employee advocacy tool

An employee advocacy tool like Hootsuite Amplify can help empower employees or contractors to share pre-approved content while maintaining brand consistency and compliance. It’s a way to reduce risk while still encouraging your team to share branded messages

Pro tip: You can also disable the editing feature to ensure that messages are accurately conveyed every time they’re shared.

Review influencer partnerships

If you collaborate with influencers or brand ambassadors who endorse financial products or services, conduct due diligence to ensure they are aware of SEC regulations.

It’s a good idea to establish clear guidelines and contractual obligations regarding compliance and disclosure to protect your brand and mitigate potential risks right from square one.

Archive everything

If there’s ever a question about your compliance, the SEC is going to want to dig back in time, so keep those receipts.

It is crucial to archive all of your brand’s social media communications to maintain a complete record of interactions, ensuring compliance with record-keeping requirements.

Hot collab alert: Hootsuite integrates with Proofpoint, offering seamless archiving capabilities and enhanced security.

Conduct regular audits

Sorry to be the bearer of bad news, but SEC compliance is not a one-day affair — it’s an ongoing process.

That means brands should regularly review and audit social media activities to identify any potential gaps or areas of non-compliance. Pop it in your calendar to do annually to make sure you’re catching issues promptly and implementing corrective measures before things go too far.

Read more about social media compliance and how to set up a social media compliance process for your team here.

Implement review processes

Getting two sets of eyes on every tweet is the easiest way to catch problem content before it goes out into the world.

Establish internal review processes to review and approve content before it is published on social media. This can help ensure compliance with SEC regulations and (bonus!) lets your team maintain consistency in messaging across platforms.

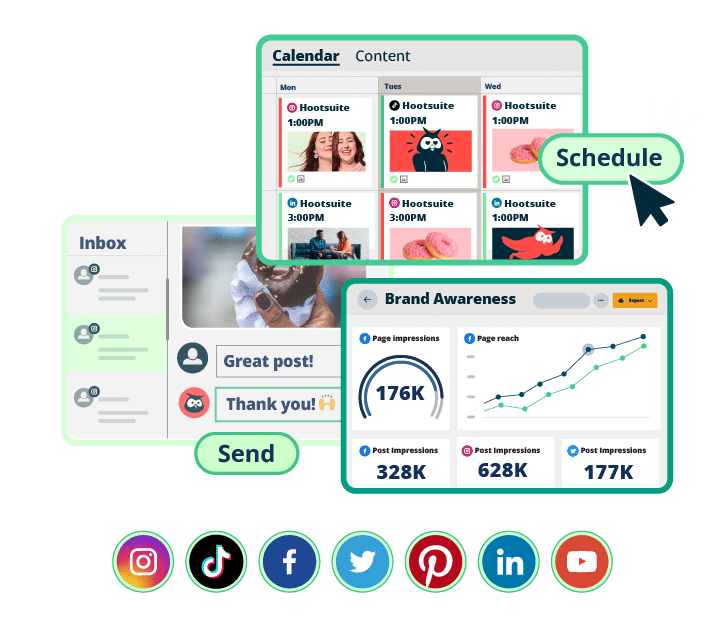

One easy way to do this? Set up an approval workflow using Hootsuite’s social media dashboard.

Leverage social media management tools

Okay, we know we’re a broken record here, but seriously: social media management platforms like Hootsuite, which offer advanced features for compliance monitoring and management, can help streamline your social media activities, ensure brand consistency, and provide archival capabilities for regulatory purposes.

We’ve got a free trial for you here!

Stay updated on SEC guidance

We’re all growing and changing all the time… and so is the SEC.

Keep abreast of any updates or guidance issued by the SEC regarding social media sites and securities regulations so that you don’t accidentally put yourself in hot water, breaking a rule you didn’t know existed.

Follow the SEC on social, and watch their press release page closely so that you can adapt your strategies and practices accordingly, ensuring ongoing compliance.

FAQs about the SEC and social media

Does the SEC regulate social media?

Yes, the SEC actively regulates social media pages to prevent fraud, ensure fair disclosure, and protect investors.

Avoid sharing misleading statements or insider information, and always disclose any conflicts of interest.

Share material information in a timely matter, and don’t engage in manipulative behavior. Let’s create an internet with no more pump-and-dump schemes, please and thank you.

Which influencers were charged by the SEC?

In recent years, several influencers have faced charges by the SEC for violating securities laws over social media, including cases involving undisclosed endorsements and fraudulent investment schemes. These charges underscore the importance of transparency and compliance for influencers operating in the financial realm.

Notably, in December 2022, eight influencers were charged in a $100-million securities fraud case. The defendants were accused of feeding a steady stream of misinformation to their social media followers in order to falsely inflate the value of stocks they held.

Save time managing your social media presence and stay compliant with Hootsuite. From a single dashboard you can publish and schedule posts, connect with new clients, measure results, and get your posts approved by managers and compliance officers.

Book a personalized, no-pressure demo to see how Hootsuite helps financial services:

→ Drive revenue

→ Prove ROI

→ Manage risk and remain compliant

→ Simplify social media marketing

The post The SEC and Social Media: What NOT to Do + Compliance Tips appeared first on Social Media Marketing & Management Dashboard.

Categories

- 60% of the time… (1)

- A/B Testing (2)

- Ad placements (3)

- adops (4)

- adops vs sales (5)

- AdParlor 101 (43)

- adx (1)

- algorithm (1)

- Analysis (10)

- Apple (1)

- Audience (1)

- Augmented Reality (1)

- authenticity (1)

- Automation (1)

- Back to School (1)

- best practices (2)

- brand voice (1)

- branding (1)

- Build a Blog Community (12)

- Case Study (3)

- celebrate women (1)

- certification (1)

- Collections (1)

- Community (1)

- Conference News (1)

- conferences (1)

- content (1)

- content creation (11)

- content curation (1)

- content marketing (1)

- contests (1)

- Conversion Lift Test (1)

- Conversion testing (1)

- cost control (2)

- Creative (6)

- crisis (1)

- Curation (1)

- Custom Audience Targeting (4)

- Customer service (1)

- Digital Advertising (2)

- Digital Marketing (6)

- DPA (1)

- Dynamic Ad Creative (1)

- dynamic product ads (1)

- E-Commerce (1)

- eCommerce (2)

- Ecosystem (1)

- email marketing (3)

- Employee advocacy (2)

- employee advocacy program (1)

- employee advocates (1)

- engineers (1)

- event marketing (1)

- event marketing strategy (1)

- events (1)

- Experiments (29)

- F8 (2)

- Facebook (64)

- Facebook Ad Split Testing (1)

- facebook ads (18)

- Facebook Ads How To (1)

- Facebook Advertising (30)

- Facebook Audience Network (1)

- Facebook Creative Platform Partners (1)

- facebook marketing (1)

- Facebook Marketing Partners (2)

- Facebook Optimizations (1)

- Facebook Posts (1)

- facebook stories (1)

- Facebook Updates (2)

- Facebook Video Ads (1)

- Facebook Watch (1)

- fbf (11)

- first impression takeover (5)

- fito (5)

- Fluent (1)

- Get Started With Wix Blog (1)

- Google (9)

- Google Ad Products (5)

- Google Analytics (1)

- Guest Post (1)

- Guide (1)

- Guides (32)

- Halloween (1)

- Healthcare (1)

- holiday marketing (1)

- Holiday Season Advertising (7)

- Holiday Shopping Season (4)

- Holiday Video Ads (1)

- holidays (4)

- Hootsuite How-To (3)

- Hootsuite HQ (1)

- Hootsuite Life (1)

- how to (6)

- How to get Instagram followers (1)

- How to get more Instagram followers (1)

- i don't understand a single thing he is or has been saying (1)

- if you need any proof that we're all just making it up (2)

- Incrementality (1)

- influencer marketing (1)

- Infographic (1)

- Instagram (39)

- Instagram Ads (11)

- Instagram advertising (8)

- Instagram best practices (1)

- Instagram followers (1)

- Instagram Partner (1)

- Instagram Stories (2)

- Instagram tips (1)

- Instagram Video Ads (2)

- invite (1)

- Landing Page (1)

- Legal (1)

- link shorteners (1)

- LinkedIn (22)

- LinkedIn Ads (2)

- LinkedIn Advertising (2)

- LinkedIn Stats (1)

- LinkedIn Targeting (5)

- Linkedin Usage (1)

- List (1)

- listening (2)

- Lists (3)

- Livestreaming (1)

- look no further than the new yorker store (2)

- lunch (1)

- Mac (1)

- macOS (1)

- Marketing to Millennials (2)

- mental health (1)

- metaverse (2)

- Mobile App Marketing (3)

- Monetizing Pinterest (2)

- Monetizing Social Media (2)

- Monthly Updates (10)

- Mothers Day (1)

- movies for social media managers (1)

- new releases (11)

- News (79)

- News & Events (12)

- no one knows what they're doing (2)

- Non-profit (2)

- OnlineShopping (2)

- or ari paparo (1)

- owly shortener (1)

- Paid Media (2)

- People-Based Marketing (3)

- performance marketing (5)

- Pinterest (34)

- Pinterest Ads (11)

- Pinterest Advertising (8)

- Pinterest how to (1)

- Pinterest Tag helper (5)

- Pinterest Targeting (6)

- platform health (1)

- Platform Updates (8)

- Press Release (2)

- product catalog (1)

- Productivity (10)

- Programmatic (3)

- quick work (1)

- Real estate (4)

- Reddit (3)

- reels (1)

- Reporting (1)

- Resources (28)

- ROI (1)

- rules (1)

- Seamless shopping (1)

- share of voice (1)

- Shoppable ads (4)

- short-form video (1)

- shorts (1)

- Skills (25)

- SMB (1)

- SnapChat (28)

- SnapChat Ads (8)

- SnapChat Advertising (5)

- Social (150)

- social ads (1)

- Social Advertising (14)

- social customer service (1)

- Social Fresh Tips (2)

- Social listening (2)

- Social Media (5)

- Social media analytics (3)

- social media automation (1)

- social media content calendar (1)

- Social media content creation (2)

- Social media engagement (6)

- social media for events (1)

- social media management (2)

- Social Media Marketing (49)

- social media monitoring (1)

- Social Media News (4)

- Social media scheduling (1)

- social media statistics (1)

- Social media stats (1)

- Social Media Strategy (9)

- social media tools (8)

- social media tracking in google analytics (1)

- social media tutorial (2)

- Social Toolkit Podcast (1)

- Social Video (7)

- stories (1)

- Strategy (817)

- Template (2)

- terms (1)

- Testing (2)

- there are times ive found myself talking to ari and even though none of the words he is using are new to me (1)

- they've done studies (1)

- this is also true of anytime i have to talk to developers (1)

- tiktok (9)

- tools (1)

- Topics & Trends (3)

- Trend (12)

- Twitter (15)

- Twitter Ads (5)

- Twitter Advertising (4)

- Uncategorised (9)

- Uncategorized (13)

- url shortener (1)

- url shorteners (1)

- vendor (2)

- video (11)

- Video Ads (7)

- Video Advertising (8)

- virtual conference (1)

- we're all just throwing mountains of shit at the wall and hoping the parts that stick don't smell too bad (2)

- web3 (2)

- where you can buy a baby onesie of a dog asking god for his testicles on it (2)

- yes i understand VAST and VPAID (1)

- yes that's the extent of the things i understand (1)

- YouTube (13)

- YouTube Ads (4)

- YouTube Advertising (9)

- YouTube Video Advertising (5)