6 Reasons Why Banks Need Social Media Monitoring

In today’s economic market, avoiding problems before they develop into full-scale crises is more important than ever. But how can you stay informed when there’s so much going on? Enter social media monitoring for banks — the best way for financial institutions to monitor online sentiment and stay ahead of the curve.

In this article, we’ll explore how banks can use social media monitoring tools to protect their reputation, connect with their audience, and elevate their social strategy.

Bonus: Download a free guide to learn how to use social media monitoring to boost sales and conversions today. No tricks or boring tips—just simple, easy-to-follow instructions that really work.

What is social media monitoring for banks?

Social media monitoring allows you to track hashtags, keywords, and mentions relevant to your brand. It’s a great way to stay informed about your audience and industry.

For banks and other businesses in financial services, social media monitoring offers an invaluable way to understand your customer base. You can listen in on your audience, addressing problems before they snowball and developing new products and campaigns that align with their needs.

Why social media monitoring is important for banks

1. Protect your reputation

We know that social media is a great way to connect with your audience — but it’s a conversation, not a monologue.

That two-way street means listening to what your audience is saying, especially when they’re not happy, is absolutely critical.

A good social media monitoring tool allows you to better understand how people talk about your brand online. When you’re monitoring social media, you can respond to critical messages before your reputation takes a hit.

Hello! We are deeply sorry about the experience you had as this is not the way we want our customers to feel about our services. Please send us a DM, we appreciate the opportunity to escalate this situation for you. Thank you! ^ML https://t.co/jAczEAxsKu

— BMO (@BMO) June 14, 2023

If you want to know the general tone of all conversations that mention your business, you can tap into customer emotions and opinions using a social sentiment analysis. This can help you preempt any potential issues and take steps to redress them before they turn into a PR nightmare.

The information you gain from social media monitoring can also help you pinpoint what your customers care about. You can use this data to craft relevant messaging and stay current with trends.

2. Improve customer support

With call center wait times increasing, many customers turn to social media for faster answers to simple questions.

Social channels often field everything from simple yes/no questions to complex issues. Some banks offer assistance via Instagram DM. Others funnel these requests to Twitter or their websites.

Good afternoon Kelly, thanks so much for reaching out to TD! We appreciate your question, and we would be more than happy to provide you with instructions for logging into EasyWeb. If you can send us a DM, we can discuss this with you further. ^BH

— TD (Canada) (@TD_Canada) May 29, 2023

You can use social media monitoring to find out which platforms your customers prefer, then create a support strategy tailored to that platform.

Just be sure to manage expectations by advertising the hours during which the account is being monitored.

3. Keep an eye on your competitors

A social media monitoring tool like Hootsuite’s Streams is a great way to gather insights about your competition.

You can monitor accounts, hashtags, and trending phrases to see what’s happening on another bank’s support account, check how people are responding to their ongoing campaigns, and more.

These insights also make it easier to track industry trends and identify gaps that your bank may be able to fill.

4. Connect with your audience

Social media monitoring can help you put out customer service fires, but it also makes building and strengthening relationships with prospective and existing clients easy.

One way to do this is to become a resource for your audience. Use your social channels to share useful or timely information, like tips on opening a savings account or tax time reminders.

Over time, your followers will view you as a trusted resource. Building that trust is especially important for banks, whose customers must trust them with their money.

5. Find new partners

Sponsorships are a vital part of any bank’s PR strategy, and major banks have their pick of major events to sponsor all year round.

RBC, for example, has presented the Canadian Open since 2008. The US Open is sponsored by three financial institutions (American Express, Chase Bank, and J.P. Morgan).

But what about smaller sponsorships that make an impact closer to home?

Look out Bob the Builder!

https://t.co/ce98DeI8a2

— U.S. Bank (@usbank) November 17, 2022

With social media monitoring, you can find out what’s most important to your community and make a difference on a local level.

6. Track campaign compliance and performance

Banking is a highly regulated industry. In addition to creating content, you must ensure that it meets all federal or local regulations and social media legalities.

These include data privacy, advertising, content moderation, intellectual property rights, and disclosure requirements.

A good social media monitoring tool (like, *ahem* Hootsuite) makes it easy to stay organized and keeps all team members on the same page. You can use these tools to quickly review performance across your social media channels and track your ongoing campaigns.

Hootsuite is compliant with industry regulations, including FINRA, FCA, FFIEC, IIROC, SEC, PCI, AMF, and MiFID II requirements, so you can centralize your compliance oversight.

5 social media monitoring tools for banks

1. Hootsuite

Hootsuite allows you to manage and monitor all of your social media platforms in one place. Banks that use Hootsuite for social media monitoring have access to many powerful tools, including:

Analytics

Hootsuite’s social media analytics tool lets you easily track the performance of all your social channels in one place. Monitor metrics like reach, engagement rate, impressions, and more. Generate reports to share with your colleagues or other departments.

Streams

Your bank needs to monitor competitors, stay engaged with relevant online conversations, and protect your reputation.

With Streams, you can create custom feeds to see social posts relevant to your business. You can also filter posts by account, keyword, hashtags, and even location.

Inbox

Never miss a DM again! Hootsuite’s powerful social inbox allows you to measure customer satisfaction and keep an eye on audience sentiment.

This handy tool displays all your social media messages in one place, so you can bridge the gap between social media engagement and customer service.

Insights, powered by Brandwatch

Hootsuite Insights lets you listen in on what customers say, feel, and think to generate your social sentiment analysis in a snap. From there, you can create effective strategies to grow your brand, boost sales, and beat competitors to the punch.

Book a free Hootsuite demo today

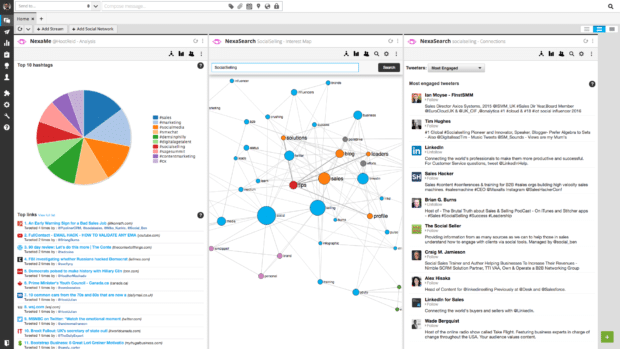

2. Nexalogy

Nexalogy offers top-tier data visualizations that can take your social monitoring to the next level.

On top of monitoring popular keywords and most active accounts, the tool includes advanced goodies like interactive timelines, geolocation-based heat maps, and lexical cluster maps.

3. Mentionlytics

Mentionlytics is a professional-grade social media monitoring app that tracks mentions, keywords, and sentiment across multiple languages.

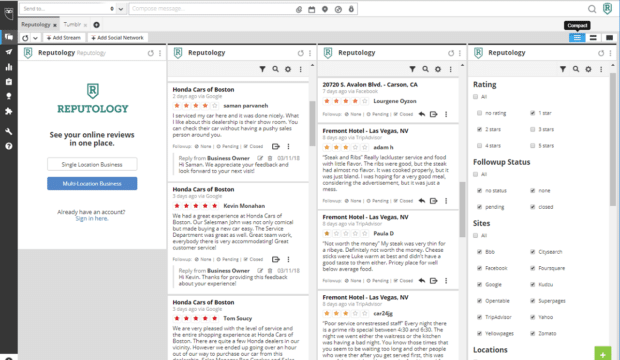

4. Reputology

For customer-facing businesses, a bad review can be devastating if it isn’t dealt with quickly. Reputology lets you monitor major review sites such as Yelp, Google, and Facebook reviews from one dashboard.

You can track activity across multiple storefronts and locations, and respond using quick links.

5. Talkwalker

Talkwalker offers more than 50 filters to monitor conversations across 150 million data sources, including blogs, forums, videos, news sites, review sites, and social networks.

You can easily analyze engagement, reach, comments, and brand sentiment.

Bonus: Watch our AMA with Talkwalker here to learn more.

Frequently asked questions about social media monitoring for banks

How is social media used in the banking industry?

Banks use social media to reach their audience and market their products. Many banks also use social media to provide customer service via DM.

Why should a bank use social media monitoring?

With social media monitoring, banks can get a better understanding of their customer base, see how their current offerings are doing, and stay ahead of trends when developing new products and campaigns.

What can be monitored on social media?

Banks can use social media to monitor everything related to their brand and industry. This includes hashtags, keywords, mentions, news articles, and online conversations.

Which regulations cover the use of social media by banks?

Banking is a highly regulated industry. Social media posts and interactions must comply with federal and local laws. Regulators covering social media use by banks include FINRA, FCA, FFIEC, IIROC, SEC, PCI, AMF, and MiFID II.

What should banks keep in mind when using social media?

Every social media platform has its own legal requirements. Banks must ensure that they comply with rules surrounding data privacy, advertising, content moderation, intellectual property rights, and disclosure requirements for each platform where they have a presence.

Hootsuite makes social media monitoring easy for banks and financial service professionals. Manage all your networks, drive revenue, provide customer service, mitigate risk, and stay compliant — all from a single dashboard. See how Hootsuite can work for your business.

Get more leads, engage customers and stay compliant with Hootsuite, the #1 social media tool for financial services.

Book a DemoThe post 6 Reasons Why Banks Need Social Media Monitoring appeared first on Social Media Marketing & Management Dashboard.

Categories

- 60% of the time… (1)

- A/B Testing (2)

- Ad placements (3)

- adops (4)

- adops vs sales (5)

- AdParlor 101 (43)

- adx (1)

- algorithm (1)

- Analysis (10)

- Apple (1)

- Audience (1)

- Augmented Reality (1)

- authenticity (1)

- Automation (1)

- Back to School (1)

- best practices (2)

- brand voice (1)

- branding (1)

- Build a Blog Community (12)

- Case Study (3)

- celebrate women (1)

- certification (1)

- Collections (1)

- Community (1)

- Conference News (1)

- conferences (1)

- content (1)

- content curation (1)

- content marketing (1)

- contests (1)

- Conversion Lift Test (1)

- Conversion testing (1)

- cost control (2)

- Creative (6)

- crisis (1)

- Curation (1)

- Custom Audience Targeting (4)

- Digital Advertising (2)

- Digital Marketing (6)

- DPA (1)

- Dynamic Ad Creative (1)

- dynamic product ads (1)

- E-Commerce (1)

- eCommerce (2)

- Ecosystem (1)

- email marketing (3)

- employee advocacy program (1)

- employee advocates (1)

- engineers (1)

- event marketing (1)

- event marketing strategy (1)

- events (1)

- Experiments (29)

- F8 (2)

- Facebook (64)

- Facebook Ad Split Testing (1)

- facebook ads (18)

- Facebook Ads How To (1)

- Facebook Advertising (30)

- Facebook Audience Network (1)

- Facebook Creative Platform Partners (1)

- facebook marketing (1)

- Facebook Marketing Partners (2)

- Facebook Optimizations (1)

- Facebook Posts (1)

- facebook stories (1)

- Facebook Updates (2)

- Facebook Video Ads (1)

- Facebook Watch (1)

- fbf (11)

- first impression takeover (5)

- fito (5)

- Fluent (1)

- Get Started With Wix Blog (1)

- Google (9)

- Google Ad Products (5)

- Google Analytics (1)

- Guest Post (1)

- Guides (32)

- Halloween (1)

- holiday marketing (1)

- Holiday Season Advertising (7)

- Holiday Shopping Season (4)

- Holiday Video Ads (1)

- holidays (4)

- Hootsuite How-To (3)

- Hootsuite Life (1)

- how to (6)

- How to get Instagram followers (1)

- How to get more Instagram followers (1)

- i don't understand a single thing he is or has been saying (1)

- if you need any proof that we're all just making it up (2)

- Incrementality (1)

- influencer marketing (1)

- Infographic (1)

- Instagram (39)

- Instagram Ads (11)

- Instagram advertising (8)

- Instagram best practices (1)

- Instagram followers (1)

- Instagram Partner (1)

- Instagram Stories (2)

- Instagram tips (1)

- Instagram Video Ads (2)

- invite (1)

- Landing Page (1)

- link shorteners (1)

- LinkedIn (22)

- LinkedIn Ads (2)

- LinkedIn Advertising (2)

- LinkedIn Stats (1)

- LinkedIn Targeting (5)

- Linkedin Usage (1)

- List (1)

- listening (2)

- Lists (3)

- Livestreaming (1)

- look no further than the new yorker store (2)

- lunch (1)

- Mac (1)

- macOS (1)

- Marketing to Millennials (2)

- mental health (1)

- metaverse (2)

- Mobile App Marketing (3)

- Monetizing Pinterest (2)

- Monetizing Social Media (2)

- Monthly Updates (10)

- Mothers Day (1)

- movies for social media managers (1)

- new releases (11)

- News (79)

- News & Events (12)

- no one knows what they're doing (2)

- OnlineShopping (2)

- or ari paparo (1)

- owly shortener (1)

- Paid Media (2)

- People-Based Marketing (3)

- performance marketing (5)

- Pinterest (34)

- Pinterest Ads (11)

- Pinterest Advertising (8)

- Pinterest how to (1)

- Pinterest Tag helper (5)

- Pinterest Targeting (6)

- platform health (1)

- Platform Updates (8)

- Press Release (2)

- product catalog (1)

- Productivity (10)

- Programmatic (3)

- quick work (1)

- Reddit (3)

- reels (1)

- Reporting (1)

- Resources (30)

- ROI (1)

- rules (1)

- Seamless shopping (1)

- share of voice (1)

- Shoppable ads (4)

- short-form video (1)

- shorts (1)

- Skills (26)

- SMB (1)

- SnapChat (28)

- SnapChat Ads (8)

- SnapChat Advertising (5)

- Social (153)

- social ads (1)

- Social Advertising (14)

- social customer service (1)

- Social Fresh Tips (2)

- Social Media (5)

- social media automation (1)

- social media content calendar (1)

- social media for events (1)

- social media management (2)

- Social Media Marketing (49)

- social media monitoring (1)

- Social Media News (4)

- social media statistics (1)

- social media tracking in google analytics (1)

- social media tutorial (2)

- Social Toolkit Podcast (1)

- Social Video (5)

- stories (1)

- Strategy (768)

- terms (1)

- Testing (2)

- there are times ive found myself talking to ari and even though none of the words he is using are new to me (1)

- they've done studies (1)

- this is also true of anytime i have to talk to developers (1)

- tiktok (9)

- tools (1)

- Topics & Trends (3)

- Trend (12)

- Twitter (15)

- Twitter Ads (5)

- Twitter Advertising (4)

- Uncategorised (9)

- Uncategorized (13)

- url shortener (1)

- url shorteners (1)

- vendor (2)

- video (11)

- Video Ads (7)

- Video Advertising (8)

- virtual conference (1)

- we're all just throwing mountains of shit at the wall and hoping the parts that stick don't smell too bad (2)

- web3 (2)

- where you can buy a baby onesie of a dog asking god for his testicles on it (2)

- yes i understand VAST and VPAID (1)

- yes that's the extent of the things i understand (1)

- YouTube (13)

- YouTube Ads (4)

- YouTube Advertising (9)

- YouTube Video Advertising (5)